Gen AI Cost Structures & Pricing Strategies Part 1: Business Value Justification and Agentic AI

In October, Anthropic released its “Computer Use” capability in public beta, enabling Gen AI Agents to navigate users’ personal devices and complete tasks semi-autonomously. This hugely-viral announcement has ushered Agentic Gen AI use cases into the mainstream, a significant start to what Gartner calls the top strategic technology trend for 2025 and beyond.

These new, cutting-edge capabilities are fueling investor enthusiasm in an aspirational, yet realistic workplace future where autonomous Gen AI Agents heavily augment employees’ capabilities. In line with software’s history, pricing for this new category of products will initially mimic what purchasing decision-makers are comfortable with, before evolving into an strategy that’s optimized for its unique characteristics, such as cost structure.

Agentic Gen AI’s anticipated prominence will have significant implications on cost structures and pricing strategies. Specifically, the emergence of Gen AI Agents weaves seamlessly into the ongoing trend towards Outcome-Based pricing (pricing based on successful business outcomes), fueled by products’ heightened need for business value justification and an improved ability to track successful customer results.

This article is Part 1 of Carya’s series on how upcoming Generative AI advancements will impact cost structures and pricing strategies. Part 1 first explores the need for business value justification and software pricing as a lever towards communicating this justification. Next, this article will provide an overview of Agentic Gen AI, finally walking through software pricing strategies and how they relate to business value justification and are impacted by AI Agents' increased prominence.

Ultimately, we conclude that Agentic Gen AI will accelerate the shift away from pure consumption-based pricing towards that of measurable customer outcomes that’s happened as a result of the need for business value justification.

For an exploration on how Gen AI Edge Computing shifts Gen AI products towards the traditional Silicon Valley “Zero Marginal Costs” model and this development’s resultant cost and pricing implications, reference Part 2 (coming soon).

The Need for Business Value Justification

Definition

For the purposes of this article, the “need for business value justification” refers to two concepts. First, to justify their investment, a company requires their products to yield economic value exceeding the invested amount. Software often is iterated on constantly in an agile way, meaning that even when a product is released, time and money is continually invested. As a result, this continuous investment needs to be economically viable to be justifiable, and the pricing of these products must account for these perpetual iterations.

Additionally, the “need for business value justification” also concerns companies purchasing products. For a B2B customer to purchase a piece of software, that software should communicate, and therefore justify, the business value it provides to its users. If the communication of this business value is not clear, customers may see the product as ineffective and thus not choose to purchase it. In other words, the employees who oversee B2B software purchasing decisions, referred to as Purchasing Decision-Makers for the purposes of this article, require tangible justification of the product's business value.

Origin

To understand the rise of Outcome-Based pricing that’s become more prominent since around 2020, it’s important to consider the increased need for business value justification. This increased need happened in part due to the economic contexts, technological advancements, and market dynamics of that period. Note that this development concerns the need for business value justification for companies purchasing products, not the companies developing them (which is more applicable in later sections of this article, as well as in Part 2 of this series [coming soon]).

The primary economic shift of note concerns the move away from the quantitative easing and zero-interest-rate policy that fueled tech’s 2009-2022 explosive growth. As rates rose and inflation steepened, companies needed to become more profitable, as not only did investors have a renewed increase in shorter-term profitability, but loans were more expensive to obtain, as well. Thus, companies had to increase the prices of their own B2B software while the buyers of this software had to cut costs, viewing purchases with increased scrutiny. As a result, necessary price-increases came with a significant churn-risk.

Therefore, the best way to mitigate that risk while still increasing prices is to justify these higher fees with a clear indication of the business value a product provides. After all, even if companies improve their products, if they cannot effectively communicate to customers why said improvements will lead to a positive ROI in an economically-cautious environment, the enhancements themselves will not justify a price increase.

In addition to these economic factors, technological advancements of this era (including improved data analytics and tracking capabilities) made it easier for companies to measure outcomes and link them to pricing, facilitating the implementation of these models. This differentiator, which made Purchasing Decision-Makers more confident in a product’s value, proved advantageous considering the increasingly saturated B2B software market.

Moreover, the market dynamics of this period, namely the increasingly saturated B2B SaaS space of the late 2010s, further contributed towards the advantage of justifying the value products provide their customers. The combination of quantitative easing and heightened accessibility of enterprise-grade software development (as well as hosting said software on the cloud) made it easier than ever to build a B2B SaaS startup. Thus, this created augmented pricing pressure which clearly justifying business value helped navigate.

Pricing Implications

A primary lever for communicating business value justification towards customers is through pricing. Namely, by aligning the way products are priced closely with the value they provide, customers can clearly see that they are receiving, ideally, more value from said products than they are paying for them, and thus have no problem continuing to purchase these offerings.

As we’ll explore below, this pricing lever has manifested in a general shift from Subscription-Based pricing (which, despite its useful simplicity, does not include any business value justification) to Usage-Based pricing (that does partially justify value through ensuring its used, though does not ensure that the product is used successfully) to Outcome-Based pricing (which is more difficult to measure, though justifies its value through ensuring successful user outcomes inherently through its pricing).

The remainder of this article will first give an overview on Agentic Gen AI use cases, before walking through the three aforementioned primary pricing strategies and describing the hypothesized impact Agentic Gen AI will have on them. While there is a continued need for all these pricing categories, due to Agentic Gen AI’s measurable successful outcomes, these use cases will accelerate the shifts towards Outcome-Based pricing.

Overview of Agentic Gen AI

In a November 20VC podcast with Sam Altman, Altman defines AI Agents today as, “...something that I can give a long duration task to and provide minimal supervision during execution for.” In other words, AI Agents have the ability for Gen AI prompts to be run autonomously, thus being able to perform multi-turn tasks and complete actions without (or with minimal) human interference.

Agentic AI uses a four-step process for problem solving: Perceiving, Reasoning, Acting, and Learning:

Perceiving refers to an AI Agent gathering and processing data from various sources (i.e. databases, sensors, etc.)

Reasoning employs an LLM-powered Orchestrator (for more on Orchestration, reference this article) that understands a given task and generates solutions that it can assign to other AI Agents.

In this way, the LLM-powered Orchestrator functions as a “CEO AI Agent” which creates and assigns various actions that other AI Agents complete, as well as coordinates between these other Agents.

Acting is the execution-oriented step that AI Agents complete, leveraging integrations with external tools and software (via APIs) to quickly complete tasks based on the plans that the CEO Agent has formulated.

Various tasks may require a human-in-the-loop to provide minimal supervision of these tasks (such as confirming a purchase), though these Agents largely act autonomously.

Learning outlines Agentic AI’s continuous improvement through a feedback loop, or data flywheel, where the data generated from its interactions is fed into the system to enhance models.

Consider the task of writing an essay. In a non-agentic workflow, an LLM will type out this essay from start to finish in one go, without even using a backspace (i.e. editing any content once it has been generated). In an Agentic workflow, conversely, the CEO AI Agent would first employ Reasoning, going through this prompt and generating a list of tasks: “Research XYZ about the essay’s topic.”, “Read through various similar essays to determine a novel thesis”, “Write an essay outline.”, “Write a first draft.”, “Consider what parts need revision or more research.”, and “Revise your draft.”. Note that for this workflow, it is not necessary to employ Perceiving to gather or process external data.

Next, the AI Agents would Act, leveraging other LLMs (and potentially specialized AI models), as well as external tools and software. These execution-focused Agents would complete the Orchestrator’s generated list of tasks, doing research about the essay’s topic (via Retrieval Augmented Generation, or RAG, the process of optimizing the output of a large language model, so it references an authoritative knowledge base outside of its training data sources before generating a response). Next, the Agents would create content based on said research and evaluate said content to ensure its quality. Note that from past interactions where a user has given feedback on past essays, the Agentic Gen AI will Learn how to best evaluate its essay content, thus employing this final step in its iterations.

Interestingly, when Sam Altman was asked in the mentioned podcast what people often get wrong about AI Agents, he stated that we often envision AI Agents’ potentials in the context of a human-optimized world. However, if we begin to imagine processes optimized for AI Agents themselves, the possibilities get much more significant.

The example that Altman uses is having AI Agents book a restaurant reservation. A human may call a couple of restaurants, which is mildly annoying and something an AI Agent may help with. However, if the restaurant-booking process was optimized for AI Agents’ unique capabilities, the Agent could call 300 restaurants at once to tailor its booking directly to your preferences. And this wouldn’t overwhelm restaurants’ booking systems since an AI Agent would be receiving these calls and could similarly process many parallel requests. As a result, restaurant bookings would be far more personalized and of higher quality than what humans (and human-optimized processes) can do. There’s already various guides on how websites can optimize for AI Agents, which include deprioritizing human-friendly UI design in lieu of standardized data schemas.

In the context of cost structures and pricing strategies, Agentic Gen AI use cases, as a consequence of their massive parallel processing capabilities, involve numerous backend processes going on all at once. These processes incur much more compute (and thus marginal costs if hosted on the cloud) than zero-shot prompts. Thus, AI Agents’ cost structures are not very intuitive towards customers. Careful consideration is required when communicating business value given this unique cost structure, which can be done via pricing strategies. For more information about AI Agents’ cost structures, reference this article.

Agentic Gen AI’s Impact on Software Pricing Strategies

Below is a table of how Agentic Gen AI impacts pricing strategies. In the remainder of this article, each primary pricing strategy will be explored through the lens of its business value justification, as well as a detailed view of how Agentic Gen AI is likely to impact it.

Subscription-Based Pricing

Business Value Justification

As referenced above, Subscription-Based pricing does not include any justification of a product’s business value. To illustrate this, consider consumer products like Rocket Money (formerly Truebill). This product’s purpose is to track subscriptions that users are unaware they still pay for in order to cancel them and save money. As many customers of Rocket Money find out, they have paid for various monthly subscriptions that have gone unused (thus providing zero value), costing a significant amount of money over time.

When translated into an Enterprise context, without careful oversight, companies could be paying for hundreds, if not thousands, of per-seat monthly subscriptions that largely go unused and provide negligible business value.

To mitigate this, B2B subscription-priced products often add detailed usage metrics and dashboards to justify a product’s business value independent of its pricing. When asked, Purchasing Decision-Makers often cite these data points as key needs for them to justify purchases to leadership.

However, the decoupling of business value justification nonetheless creates friction that is removed by linking pricing more closely with these success metrics. Even when products perform well for customer organizations, these users may still be wary about if increasing the number of purchases/licenses will further increase these metrics (and thus choose to be hesitant about additional seat assignments), and may not directly translate successful metrics into dollar outcomes (consequently not understanding the full value of the product).

Still, Subscription-Based pricing actually originated from the product developers’ needs to justify the business value of their continuous investments into their software. Initially, software was priced via the past pricing paradigm of traditional products, with fixed, static installments. However, the continuous iterations of these products (which software enables via its ability to be instantly distributed to users) required engineering manpower, translating into additional costs. Pricing based on monthly subscriptions (which provide access to the software product) helps justify this perpetual investment. This is discussed in more depth in Part 2 of this series (coming soon).

Overall, Subscription-Based pricing offers desired simplicity (especially for smaller organizations) and there are strategies towards justifying business value within this model. Still, there is still an ongoing trend towards aligning pricing, which helps establish the product team’s incentives, with customer value, which largely sets the user’s incentives.

Impact of Agentic Gen AI

Agentic Gen AI will accelerate the trend away from Subscription-Based pricing in two distinct ways: Making monthly per-seats fees less intuitive and making this pricing model risk cannibalization. Regarding the former, just as deterministic (i.e. non-Gen AI) software’s initial pricing strategy reflected that of the pricing paradigms before it (appealing to buyers’ expectations despite not fitting its cost structure’s realities), so too did Generative AI products’ initial pricings mirror that of deterministic software (i.e. monthly per-user subscription models).

In fact, many prominent Generative AI products still utilize monthly Subscription-Based pricing for both simplicity and comfortability. What makes Subscription-Based pricing intuitive for traditional B2B SaaS offerings is the SaaS model, itself. For a fixed fee, unlimited access to a piece of software is given to an employee. The employee does not have to consider how their usage habits impact its price, thus optimizing their usage solely for being an effective worker.

Agentic Gen AI, on the other hand, does not solely provide access to software for its customers. Instead, these products (especially in their longer-term aspirational use cases) often operate in the background without any human input. Thus, there is no need for the value Agentic Gen AI brings to be confined towards individual employees (i.e. Seats). For example, if an AI Agent collects useful research towards many employees, it should be able to integrate those insights into various workflows without regards to which employees have access. While these examples do not preclude Subscription-Based pricing from working for Agentic Gen AI products, they do indicate that the clarity (which is arguably per-month fees’ main benefit) is dampened.

Additionally, as Agentic Gen AI products rise in popularity, per-user monthly subscriptions may have a cannibalizing effect. These Agentic use cases often have user replacement functions, such as completing tasks that otherwise would require a larger headcount to do. As a result, per-user subscription-based pricing would, in theory, mitigate its own revenue gains if the Agentic products prove successful.

Usage-Based Pricing – Impact of Agentic Gen AI

Business Value Justification

Usage-Based pricing, as will be detailed in this section, is a decent, though not ideal proxy of business value for applied software products. As a result, there has been a general shift from this model towards Outcome-Based pricing. Usage-Based pricing will, for the purposes of this article, refer to the subset of consumption-based pricing models which charge customers by the variable amount of input usage they perform, independent of any successful business outcomes in which this usage results. Examples of Usage-Based pricing include charging per API calls to a product, per the amount of traffic a service receives, and in the context of Gen AI, per Inference token incurred by an LLM.

One of Usage-Based pricing’s most prominent early examples, cloud hosting providers (such as Amazon Web Services, Microsoft Azure, and the Google Cloud Platform), is directly tied to business value justification. These providers offer a pay-as-you-go approach for pricing for the vast majority of their services.

Before 3rd party cloud-hosted software was popular, companies would host internet-connected software products, these products’ collected data, and these products’ user traffic on local servers. These local servers were costly to set up and maintain, requiring specialized skills and dedicated personnel to do so. While large companies had established organizations and facilities to handle these servers’ operations, this was particularly difficult for startups.

Moreover, this difficulty became particularly prohibitive as products received more and more users. Eventually, the initial servers that were dedicated to a product did not have enough storage nor compute to handle all of the incoming traffic and collected data. When this occurred, companies would have to set up more expensive servers to handle the increased usage.

This left companies with two problematic choices: Either set up enough servers for a product’s current amount of usage and risk the need to set up more servers, or install more than enough servers and risk unnecessary upfront costs if usage does not increase. In both cases, because the money and manpower behind hosting software products did not directly link to justification for the business value said hosting would provide, companies were unclear on how many servers to purchase and install.

Additionally, since usage of products can vary due to external circumstances (ex. products that have seasonal changes in usage), this tradeoff was a constant consideration that often led to suboptimal outcomes.

Thus, when cloud hosting providers released their white-labeled servers on which any company could store their product (and its traffic/data/etc.), not only was outsourcing this specialized, difficult service highly-beneficial, but its Usage-Based pricing model was core to the value proposition. By only paying for the amount of usage that a company receives, cloud hosting providers directly tie pricing towards the business value they provide, enabling customers to easily scale their product to handle the exact amount of traffic it demands.

As a result, Usage-Based pricing for cloud hosting services is highly beneficial towards its customers. Not to mention, because customers no longer need to be concerned about purchasing too much server space (and thus under-purchasing), this pricing strategy likely leads to more revenue for cloud hosting providers.

This pricing strategy also makes sense for the providers themselves (in the context of business value justification). Since the use of cloud hosting services is the direct value provided to its customers (i.e. companies hosting their software), assuming there are no significant issues with the service like outages, cloud providers passing their marginal costs onto their users via Usage-Based pricing makes sense (as opposed to less correlative pricing like subscriptions).

However, unlike cloud hosting services, the value that applied B2B software provides its customers is not the ability to access this software, but in the successful business outcomes that the software produces. A hypothetical piece of B2B software, if subpar, could, despite high volumes of usage by its employees, produce very low (if any) amounts of successful business outcomes. Simply put, if a product is bad, it doesn’t matter if employees are able to use it. As a result, when decision-makers for B2B software purchases want justification for paying a product’s fees, usage is a decent, but not great proxy towards communicating the product’s value.

Following B2B technology pricing’s general theme of ‘initially price based on past pricing paradigms (with which buyers are familiar), then create unique pricing once the technology is established’, Generative AI’s initial Usage-Based pricing mirrors that of cloud-hosting providers’. Generally, this resulted in Gen AI products charging users per-query, per-token, per-character, or per-API call.

This is because when a company that’s implementing cloud-hosted Gen AI into their product purchases these APIs from incumbents (OpenAI, Anthropic, etc.), the access to this Gen AI itself is the direct value provided (contingent on the quality of the Gen AI model’s performance). As a result, product usage is an ideal proxy for the value Generative AI model creators provide.

Still, it makes less sense for these marginal costs to be passed onto the end-users of applied Gen AI products directly via Usage-Based pricing since the value Gen AI provides these end-users is not directly tied towards its usage.

Thus, B2B decision-makers may be wary of these products’ usages serving as a proxy for real-enterprise value (i.e. business value justification). As a result, while (cloud-hosted) Generative AI’s marginal costs may have initially pointed pricing strategies in the direction of Usage-Based fees, the pricing of applied Gen AI products to enterprises, like with traditional deterministic software, is shifting away from this model.

Agentic Gen AI Impact

As a result of Agentic Gen AI, the trend from Usage-Based to Outcome-Based pricing will only accelerate. In the same aforementioned 20VC podcast, the host asks about the future of Agentic Gen AI pricing since, with these use cases, “...now you’re actually… replacing labor”. Altman replies that, “I’ll speculate here for fun, but we really have no idea…I could imagine a world where you can say like I want 1 GPU or 10 GPUs or 100 GPUs to just be like turning on my problems all the time. You're not paying per seat or per agent…[but] based [on] the amount of compute.”

While this Usage-Based-pricing-future is compelling, it assumes that customers will directly tie OpenAI Agents’ business value to its input usage, scaled up by the number of GPUs dedicated towards providing said business value. In a future where customer trust in OpenAI is high enough, this may be viable. However, given the need for business value justification, this future isn’t something that B2B customers will be receptive towards any time soon.

For example, consider a scenario where two customers receive the same value from OpenAI’s Agentic use cases, but one user has more GPUs allocated to them than the other. In a future where customer trust is high enough to make Usage-Based pricing ideal, the sentiment towards this scenario would be that the higher-cost service did its job, but there was no extra value to provide. I still prefer the most expensive GPU allocation since I’ll receive the most value possible. This does not seem to be B2B’s prevailing attitude. Instead, more expensive (i.e. more GPUs allocated) product tiers must consistently communicate their heightened value, and purely Usage-Based pricing does not inherently do this.

Now consider an alternative Usage-Based pricing model, charging customers per inputted-prompt. If a user enters in a single query, “Send an email to Tom about the latest revenue forecasts.”, the agent may have to do many background queries to achieve the end-user’s desired business outcome, such as fetching the revenue forecasts, synthesizing these forecast’s top insights, composing a text-based message with these insights, and entering this text into an email which will be sent to a specific audience.

As a result, not only is the single user-inputted query not indicative of the work (and marginal costs, if the model is cloud-hosted) that went on behind the scenes, but the customer may, in the future, be incentivized to guide the agent towards less backend queries to save on costs, which would generally harm the quality of this product’s performance, putting cost incentives at odds with the product’s happy-path.

Additionally, even if product usage was a decent proxy for its provided business value, because Agentic Gen AI use cases complete measurable actions, these actions themselves are more tangible proxies.

Thus, due to the proliferation of Agentic Gen AI use cases, we hypothesize that the trend away from Usage-Based pricing towards Outcome-Based pricing will get stronger. Since Agentic AI use cases often complete measurable actions autonomously, end-user usage of these products themselves are not great proxies for the business value they provide.

Outcome-Based Pricing – Impact of Agentic Gen AI

Business Value Justification

Outcome-Based pricing, as this article has alluded towards, is a small, but impactful variation of Usage-Based pricing: Instead of charging organizations by what their users input into a product, fees are incurred based on the successful outputs of the products themselves. As a result, Outcome-Based pricing makes business value justification inherent towards how customers are charged.

While Outcome-Based pricing has existed in many forms for B2B software, arguably its most widespread mainstream application is in advertising software, such as Google Ads. Instead of charging companies for the usage of its advertising space (such as pricing per amount of websites an ad is placed within), Google Ads charges by cost per click (CPC) and cost per 1000 impressions (CPM). As a result, it is up to Google to place ads on websites where users will not only view them, but where the right targeted users will view them and, as a result, click on the ads.

This Outcome-Based pricing model aligned Google’s incentives with their customers’. In contrast, if Google employed Usage-Based pricing, they could place customers’ ads on whatever websites they want, which may perform very unsuccessfully and drive no revenue or user traffic, but still be paid for their services, nonetheless. With Outcome-based pricing, Google does not get paid unless their service provides (and thus justifies) desired business value.

Agentic Gen AI Impact

Agentic Gen AI will accelerate software’s trend towards Outcome-Based pricing due to the ease with which it can now be implemented and its increased intuitiveness in the context of AI Agents. Concerning the former, Outcome-Based pricing is harder to implement than both Subscription-Based and Usage-Based pricing. Not only must the products themselves be providing significant value (i.e. the product works as intended) to make money, but extensive tracking and operational infrastructure must be in place to properly measure (and thus charge customers for) these outcomes.

The below figures, made by L.E.K’s SaaS Outcome Pricing Analysis, illustrate the necessary elements for a successful implementation of Outcome-Based pricing and the spectrum from Usage-Based to Outcome-Based pricing that exists in the consumption pricing space. As pricing strategies, shown by L.E.K’s online job board example, shift from Usage-Based to Outcome-Based, they become more complicated to implement and more dependent on the product’s performance, making them riskier from a revenue perspective:

Five critical components of Outcome-Based pricing in SaaS

Outcome-Based pricing: Online Job Board example

Due to this difficult implementation and the willingness of Purchasing Decision-Makers to buy SaaS products without such aligned justification, Outcome-Based pricing has only recently been emerging as a widespread B2B pricing trend. However, with Agentic Gen AI use cases, this implementation difficulty is no longer the case. Since AI Agents’ are autonomously completing actions, if these actions have business value, this value is communicated through the actions’ completions, themselves. Therefore, the infrastructure needed to implement Outcome-Based pricing is already made through Agentic use cases’ product developments.

Additionally, Outcome-Based pricing in the context of AI Agents is intuitive for customers. Unlike Subscription-Based and Usage-Based pricing, which has been shown earlier in this article to be unintuitive with Agentic Gen AI use cases, the best way to cut through the noise of a new product paradigm is ‘here’s what this product has done for you, we will charge based on this…’

An area that Carya focuses on closely, Gen AI augmenting and automating customer support, has already begun to adopt Outcome-Based pricing. For example, Intercom’s July 2024 pricing for its AI Agent, Fin, charges $0.99 per resolution:

In fact, according to The Economist, …”a number of generative AI startups in the industry have adopted Outcome-Based pricing, charging for their technology when a customer query is resolved, rather than per agent or minute of interaction, as is standard”.

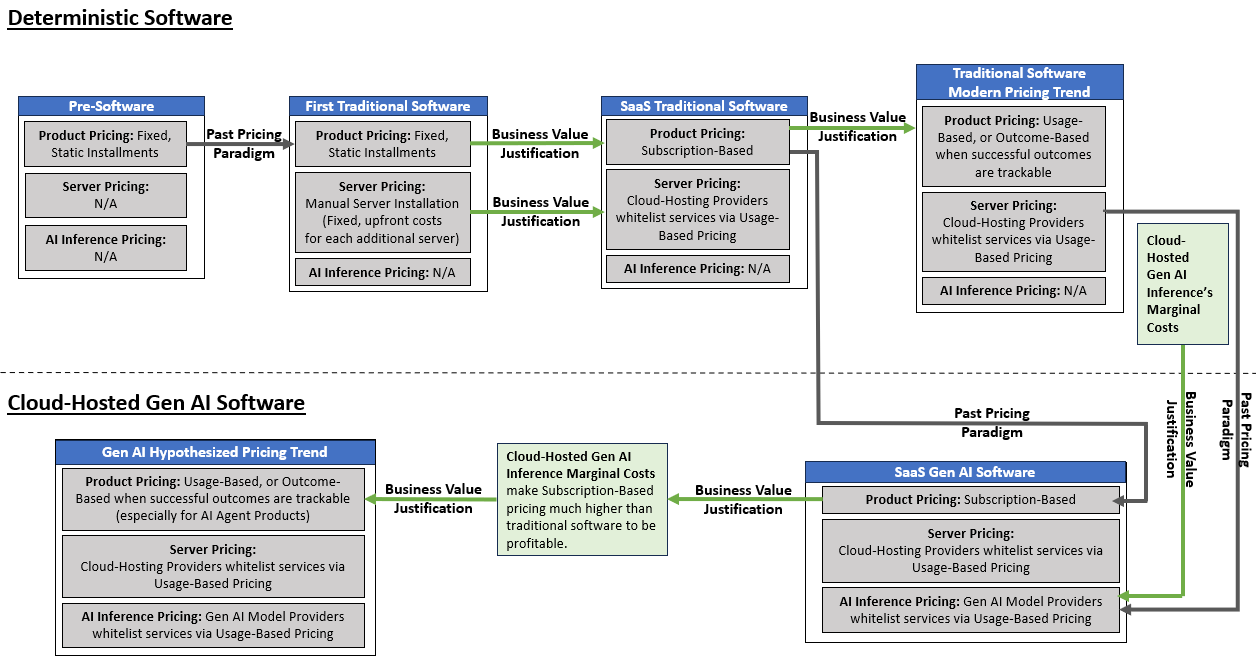

Gen AI Pricing Strategies in the Wake of AI Agents and Edge Computing – Diagram

Over the course of this article, we’ve discussed how Gen AI pricing strategies do not occur in a vacuum, but evolve primarily due to 2 influences: Past pricing paradigms with which Purchasing Decision-Makers are familiar and justifying business value through pricing. Note that, as mentioned in the beginning of this article, “Business Value Justification” refers to both a product team’s need to justify providing business value, thus continuously investing marginal costs into their product, as well as a customer’s need to recognize that they are receiving business value from a product, thus continuing to purchase it.

The below diagram visualizes these influences for both deterministic software and Cloud-Hosted Gen AI, hypothesizing that these influences will continue to push Gen AI in the direction of Outcome-Based pricing. This diagram omits how Edge-Hosted Gen AI will impact pricing, which is discussed in-depth in Part 2 of this series (coming soon).

Some of Silicon Valley’s most heated and varied discourse revolves around the exciting, yet ambiguous future of Generative AI. However, just about everyone agrees that AI Agents will play a massive part in the future of work.

In this new workplace paradigm, Outcome-Based pricing is an ideal measure of these AI Agents’ value, closely aligning their incentives to business value, which companies need to communicate to their customers more than ever. Thus, the rise of Agentic Gen AI will accelerate B2B SaaS’s pricing towards an Outcome-Based strategy, ensuring that in Generative AI’s early days, enterprises will know exactly what productivity gains they’re buying.